Trending Now

Sebastien Lobe defeated Raleigh Monte-Carlo, his 80th WRC victory

He officially retired from the rally, but continues to write their history by coming to some top freelancing: at 47 years and 11...

WORLD

TECH

Dragon Quest 12: Announcing the Flames of Destiny

Square Enix officially announced the next installment in...

Amazing offer already available for pre-order

When we talk about Android tablets, Samsung remains...

The Elder Scrolls V: Skyrim Anniversary Edition and Upgrade Promotion Overview

Get the details below, via video.■ Creations

Saints and seducers"Saints and Seducers" is a...

ECONOMY

Wall Street closes with gains after risk reduction by Omicron

Wall Street It closed slightly higher on Wednesday as investors cheered the encouraging news about Covid-19 vaccines from Pfizer and BioNTech.Pfizer and BioNTech He...

Telefónica is negotiating to sell part of its fiber network in Peru amid Hispam recovery | comp

After closing partial sales of its fiber businesses in Brazil, Chile and Colombia, Telefónica is now working on a similar operation in Peru, one...

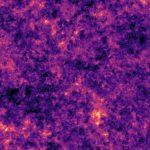

The brilliant map of dark matter that reveals a cosmic mystery

Puzzled physicists is the most detailed map of dark matter in the universe.An international team of researchers has created the largest and most detailed...

Google delays new Play Store security section on data collected by apps until April...

by Europa PressFeb 26 2022 at 09:12 AMGoogle postponed until the end of April Implementation of the security section of the...

SPORT NEWS

Loena Hendrickx after her silver at the World Figure Skating Championships: ‘I’m proud of...

It's a great performance the Belgian gave us last night.

by Belga

Published on 03/26/2022 at 11:57Reading time: 3 minutes

Loena Hendrickx...

The Pittsburgh Pirates won a game without injury

Pittsburgh.-Starter Hunter Greene and loyal Art Warren shared the hill without giving up a kick in a full game for the Cincinnati Reds,...

Cycling worlds: The Dutch forget the chaos of the Olympics

Dutch Eileen van Dijk on her way to victory in the singles time trial of the Cycling World Championships in Bruges, 20 September 2021...

France beat Italy 5-1 in the European Women’s Championship

France won and was convinced to enter the competition in European Championship Women's soccer, this Sunday in Rotherham5-1 victory over Italy.

You may be interested:...

Ligue 1: OM regains second place, Lyon says goodbye to the podium … All...

The 31st day of the French Ligue 1 Football League ended on Sunday evening. Between Lens's 3-0 win over Nice, Bordeaux's victory over...

SCIENCE

Singer Lorde heralds summer with a new song

New Zealand singer Lorde is back with a sunny song nearly four years after the release of her latest studio album, 'Melodrama'. The...

LATEST ARTICLES

Latest article

The airport is closed, and aviation safety is at risk

the Ruang volcanoin Indonesia, I wake up. In the last 24 hours there have...

“He's my uncle, he has to sign a loan.”

He took a dead man to the bank and tried to get the corpse to sign...

Who ends up in the crossfire. More aid for Ukraine – El Tempo

At a moment of extreme crisis on the international scene, the G7 foreign ministers' meeting that opened on Wednesday evening is trying to defuse...