Trending Now

Wal-O-Matt Federal Election 2021: Which party is right for me?

Bundestack election Bundestock Election 2021 Which party in Wal-O-Matt-Germany is most suitable for you? Status: 5:06...

WORLD

TECH

Roblox: Users have reported a drop in services for several hours

Online video game Roblox has suffered a decline, affecting thousands of users (Image: Europa Press)video game Roblox suffered a Drop on its platform on...

Twitch for iOS adds 350+ tabs to your Community tab

Starting next week, Twitch for iOS is adding over 350 new brands related to gender, sexual orientation, race, nationality, ability, mental health, and more.

According...

Nintendo ignites upcoming activities for Kirby’s 30th anniversary

Yesterday, Nintendo dropped an awesome new trailer for Kirby and the Forgotten Land, which also provided us with a solid March 25 release date....

ECONOMY

Total Energy operates the largest solar power plant in France

TotalEnergies operates the largest solar photovoltaic (PV) plant in France, with a capacity of 55 megawatts (MW). This power plant, located northeast of...

Deliveroo plans to leave Spain as delivery staff will have to pay their salaries

Home delivery platforms are facing a profound change in their economic model.Having come under attack at the heart of its economic business, Deliveroo opts...

Satellite Internet: A Soyuz 36 launches a new British satellites

Posted in: 05/28/2021 -...

Gwen Stefani and Blake Shelton married 8 months after their engagement

After nearly six years of relationship and only 8 months after the engagement, Gwen Stefani: famous American singer Blake Shelton They married in a...

SPORT NEWS

Becker trusts Zverev to win French Open

Monte Carlo German tennis legend Boris Becker trusts Alexander Zverev to win the French Open. "He can now get back to fitness, play until...

Repechage Clausura 2022: Background to the Fourth Qualifier Series

Midtime Opening

Mexico City / 01.05.2022 22:21:52

...

Quick historic victory: The club’s 6-0 win was the highest-ever Bundesliga win in Freiburg....

Christian Streiche was a historic victory for his company SC Freiburg A bit uncomfortable in Borussia Mönchengladbach. His team's 6-0 win on Sunday...

Nicaragua vs. Copa Live: Watch international friendly football matches live | Total...

Lima, November 13, 2021Updated on 11/13/2021 07:13 PMNicaragua against. Cuba direct | online | Directly facing each other in the match International...

Primoz Roglic in search of revenge, follow the first stage of the race to...

After suffering several failures that denied him a win last year, the Slovenian is anxiously awaiting...

SCIENCE

“Another wave in the fall coexists with the virus”

The United kingdom preparing, as Prime Minister Boris Johnson said, "to live withتعايش virusThis is what emerges from a leaked document from government departments....

LATEST ARTICLES

Latest article

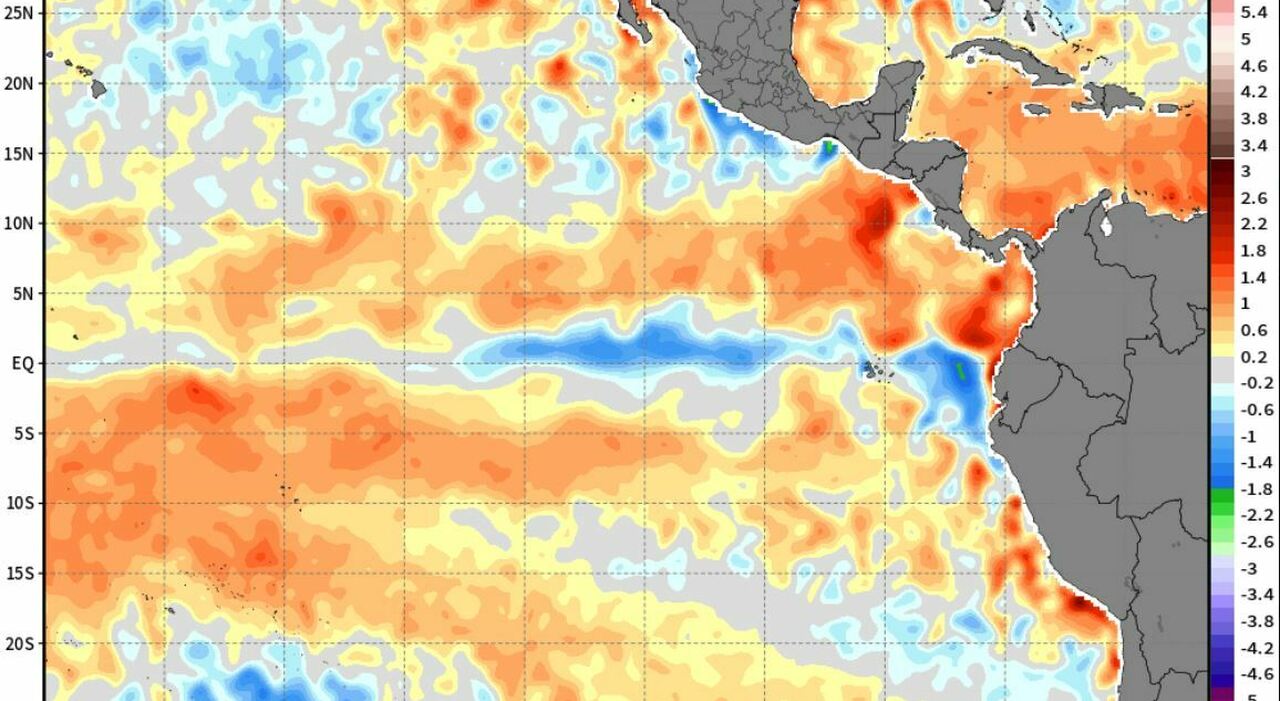

The upcoming La Niña phenomenon and the risk of earthquakes? Where, when and...

Climate change in the Pacific Ocean.. Are you already a subscriber? Log in here! special...