Trending Now

WORLD

TECH

The head of the stars with the Artemis mission

No need to wait for an Artemis rocket launch to have your head in the stars. Lego has added to the City Espace...

ECONOMY

Daniel Galindo assures that technology allows remittances to be sent from the United States to Mexico for free

To the end of the first day of Excelsior Forumpresented by KIO Networks, the latest show was presented by Daniel Galindo, Chief Marketing Officer,...

Strasbourg wants to measure the impact of the “low emissions – mobility” zone

Impact assessment of the implementation of the Low Emission Mobility Zone (ZFE-m) in Strasbourg. This system, launched by the state, aims to reduce...

delta variable shadow

New YorkNow that the initial impact of vaccination has worn off and government aid to Americans is running out, the delta variable is casting...

‘I don’t see that resemblance,’ but ‘she was the one who made me want...

Susan Lyndon, who will be releasing her first movie sixteen years old Tomorrow she will invoke her resemblance to another actress whose parents are...

RTL throws Janina Eusebian out and explains where Linda is

tzTVCreated by: 01/26/2022 11:32 amDivideMajor twist in the wild camp: Janina Youssef was expelled by the RTL for racist reporting. RTL also explained...

Salah “shocked” that he finished seventh in the Ballon d’Or

The author of a great new season with Liverpool, Mohamed Salah did not see his efforts rewarded with a place on the podium for...

ENTERTAINMENT

SPORT NEWS

Baseball – Toronto beats White Sox, Guerrero Jr hits 90

Brevich Valera scored a tiebreaker in the eighth...

Football. New Zealand chains sweep Fiji

New Zealand are in good shape and showed it again Friday night against Fiji in Dunedin (57-23).The All Blacks scored four out...

Holder of Eden Hazard against Russia to start the euro? “I’m not 100%...

The captain of the Red Devils spoke to RTBF on the eve of the team's departure to Russia, where their first match in the...

NBA Blues Night: A little bit of Batum, that’s it

It was the Clippers' opening night, on their home ground, against Memphis, but the Californians weren't out for their favour, losing (114-120) by...

football. Ligue 1: Saint-Etienne – Marseille postponed due to snow and uncertainty about...

“Due to the difficulties in accessing the Geoffroy-Guichard Stadium, the LFP (Professional...

LATEST ARTICLES

Latest article

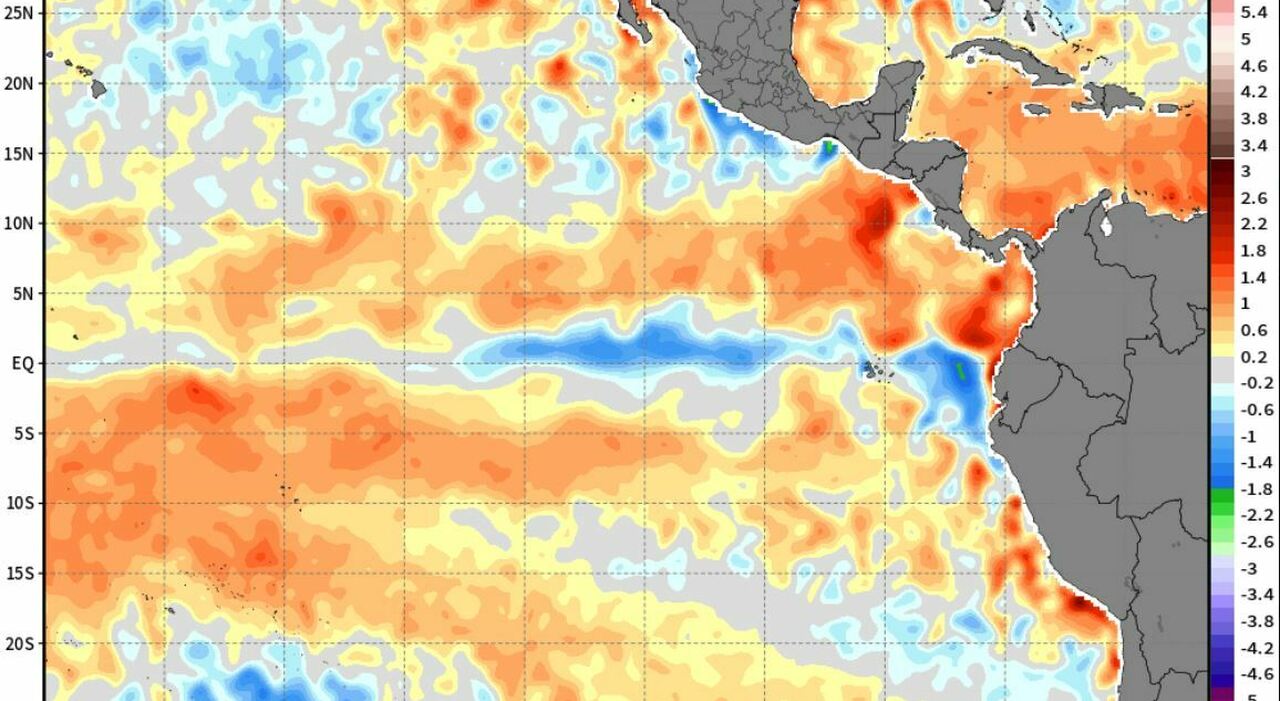

The upcoming La Niña phenomenon and the risk of earthquakes? Where, when and...

Climate change in the Pacific Ocean.. Are you already a subscriber? Log in here! special...