Trending Now

The Best Video Games of 2021

The gaming industry has made a giant leap forward in 2021. More and more studios have begun to create interesting games with beautiful graphics...

WORLD

TECH

Pokémon Shiny Diamond and Shimmering Pearl will get a 1-day update

Pokemon Shiny Diamond and Shiny PearlThe developers have confirmed that it will be necessary to install it in order to access the various features...

Scientists have been able to “date” the ancient stars in the galaxy

Scientists in the United Kingdom were able to determine the history of some of the oldest stars in the galaxy with unprecedented accuracy, by...

Instagram solves recurring stories issue with latest iOS update

Instagram has published an update to resolve the...

ECONOMY

Jim Whitehurst is stepping down as president of IBM after just 14 months

What just happened? IBM has announced a series of leadership changes that will have an immediate impact on business. The biggest revelation is...

A new report by Bova warns of the economic risks of the new constitution and says that Chile enters the stagflation scenario

Reports from banks and international entities about the new draft constitution have been in the spotlight in recent weeks. The Bank of America...

China plans to ban technology IPOs in the US due to sources of IT...

Charging...(Reuters) - China is setting rules to ban internet companies whose data poses a potential security risk from listing outside the country, including the...

“In Spain we eat dinner very late.” Deputy Prime Minister Díaz opens the...

Anyone who has visited Madrid or Seville, especially in the summer, knows the scene: all around At 10:30pm there are still many families in...

AddOn Spotlight: Angry Keystones for (WoW) World of Warcraft

Are you a WoW game enthusiast and looking for a better extension? If yes, you are in the right place! The Angry Keystones extension...

ENTERTAINMENT

SPORT NEWS

Brentford match summary. Arsenal Premier League 201-2022: Videos, goals and stats

Arteta's men face a recent promotion to open a new season in England.Arsenal will be responsible for launching the 2021-22 Premier League f ...

Euro 2021 Live: the latest news and events from the tournament today July 5...

The match between Spain and Italy will be the seventh meeting of the European Cup. In...

Olympia 2021: Simone Biles celebrates a successful comeback on the balance beam

Leaving, beaming, then capturing her heart, it seemed like a gesture of relief: Simone Biles won a bronze on the balance beam on her...

Wales (3-0): Conde, first successful and ‘option’ on the right

By Nicholas Le Guardian, Special CorrespondentPublished 6/3/2021 12:47 AMUpdated on 06/03/2021 at 12:56 AMGirondin celebrated his first pick on Wednesday against Wales with a...

SCIENCE

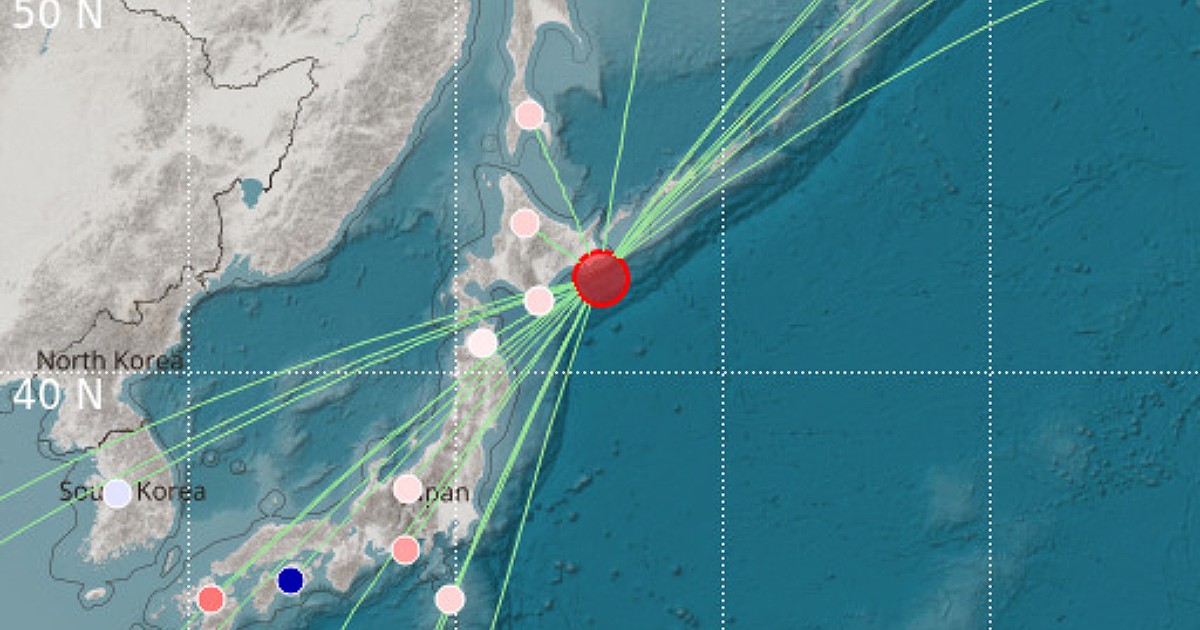

Japan earthquake measuring 6.1 on the Richter scale off the northern...

This was announced by the Japan Meteorological Agency, that the epicenter of...

LATEST ARTICLES

Latest article

TikTok, ban in the USA is a law: sell within 9 months or be...

Wednesday, April 24, 2024 It has more than 1 billion...

Free train travel, all you have to do to get tickets as a gift...

How to travel by train for free – Source Depositphotos.com – autoruote4x4.comIf you follow this procedure, you can travel around Europe without spending...