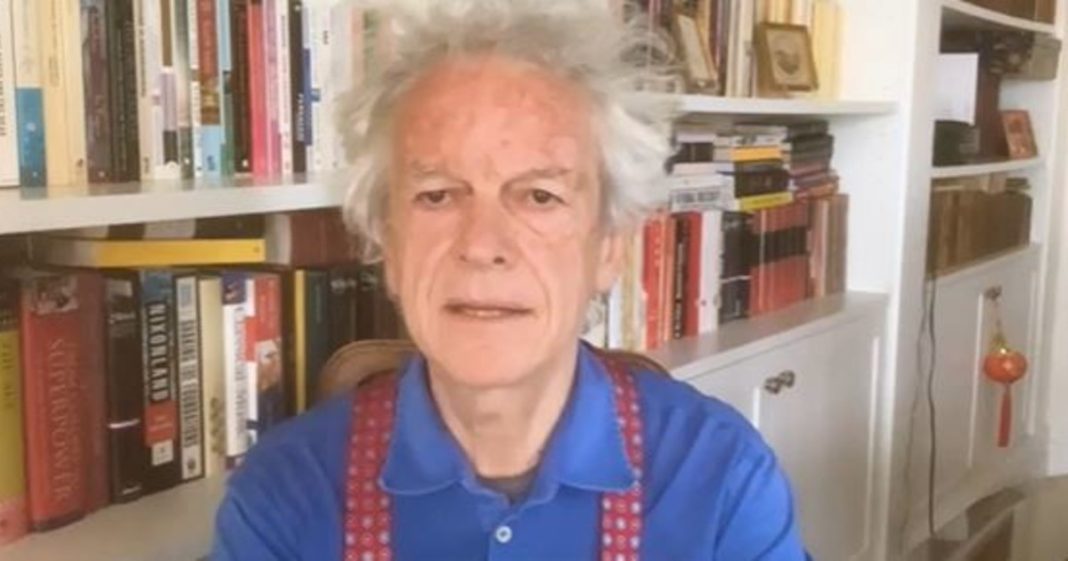

One financial tsunami On the road, which may confuse not only the markets but above all pensions. Federico Rambiniin one of his editorial videos for Corriere, speaking of “fears of an imminent recession, at least in the United States within a year or two”. The reporter stresses that inflation is more resilient than expected, and “there is a fear that Federal Reserve (US Central Bank, so) in a few hours, he may have to raise interest rates in a more aggressive and long-term way”, as the ECB President has already done in Europe Christine Lagarde A few days ago.

Rambini asserts that an increase in the cost of money reduces consumption spending and investments, “because at some point businesses and consumers always need to borrow, for investments or home loansAll this, he adds, could accelerate a recession.

“Then there is the phenomenon that is most disturbing and least understood, which isimpoverishment. High interest rates reduce the value of massive assets Warranty, of fixed income securities, which constitute the wealth of retirees. This is because even in America I am pension funds Invested in Puna.”

The last point of concern is the consequences geopolitics of the Fed’s moves. “We’ll see if the West comments on the assistanceUkraine You will withstand economic difficulties, and then there is the great challenge between the United States and China. Beijing will try once again to prove that its capitalism outperforms ours and is already operating all the levers of public spending and direction to avoid falling into recession. If China succeeds in becoming independent of the US and Western economic cycle, Rambini concludes, “Once again the Chinese can come out with their heads held high, claiming that they know how to govern the economy better than we do.”

“Reader. Travel maven. Student. Passionate tv junkie. Internet ninja. Twitter advocate. Web nerd. Bacon buff.”