Even when Mexican inflation falls outside the central bank’s target range, Analysts say it is unlikely that Banxico will trigger the first rate hike the market appreciates. That could be another boost to the recent bond rally.

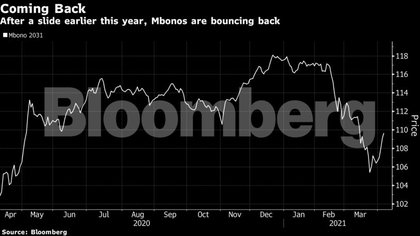

The country’s peso bonds, known as Mbonos, are on the rise as US Treasury yields stabilize and hopes for a stronger recovery in the world’s largest economy, Mexico’s largest trading partner. The MPONOS rate due in 2031 rose 2.8 cents this month to more than 109, the highest level in nearly four weeks.

If the central bank stands firm and slows rate hikes this year, defying market expectations, bonds could rise. However, Swap rate traders are unlikely to change their bets soon after inflation spiked to 4.67% in March from 3.76% the previous month. However, it is a matter of giving it time and the markets should move to reflect expectations of stable rates, said Claudia Sega, a strategist at BBVA in Mexico City.

“I don’t see it,” Sega said, referring to more than 130 basis points in market price hikes over the next two years. It could rise if inflation starts to get out of control. But the gasoline and energy shock is somewhat temporary. “

For this reason, Ceja expects a downward adjustment of the yield curve Mbonos.

Tasas swap

The swap market is quoting 25 basis points by the end of the year. Even with most economists expecting the rate to remain the same through 2022, According to Citibanamex’s most recent survey.

“The economy is bad, inflation expectations are stable, and MXN has already started to rise,” said Benito Periber, chief economist for Latin America at Natixis North America in New York. “It could rise if inflation starts to get out of control, but the effect of gasoline and energy prices is very temporary.”

Berber says Banxico will likely keep rates until May next year at least. However, although domestic monetary policy affects Mbonos’ outlook, debt in pesos will mainly respond to external factors and will follow the example of the US Federal Reserve, he said.

While Mexican inflation is high, the central bank indicated that the latest acceleration is likely to be temporary. In March, energy prices led the gains in the index, rising nearly 2.8% from February.

Inflation risk

Inflation risk remains high.

Luis Gonzali, portfolio manager at Franklin Templeton in Mexico City, says that while Banxico is expected to keep interest rates at 4%, boosting Emponnos, It does not rule out inflationary surprises to the upside and is hedging itself in inflation-related bonds, known as Udibonos.

“Without a doubt, Udibonos will benefit the most, more than Mbonos, in a year in which inflationary uncertainty will be one of the main drivers of the fixed income market,” Gonzali said.

Mexican swap rates have fallen dramatically this week, in line with the strength of the peso, lower yields on US Treasuries and minutes from Banksio pointing out. Most policymakers are still looking for opportunities to cut interest rates.

Two-year TIIE swap rates decreased 28 basis points this week. The swap curve estimates 30 basis points for interest rate hikes in the remainder of 2021, down from 60 basis points at the start of the month.

Read on:

“Unapologetic pop culture trailblazer. Freelance troublemaker. Food guru. Alcohol fanatic. Gamer. Explorer. Thinker.”