According to the Bank for International Settlements, most of the world’s central banks are developing digital currencies for central banks or are experimenting with their adoption.

Los central banks From all over the world are increasingly studying the possibility of creating a file private digital currency.

According to the survey Bank for International Settlements (BIS), nine out of ten central banks around the world are exploring central bank digital currencies (CBDCs).

The report says: “This report presents the results of a survey of 81 central banks about their participation in the work of Central Bank Digital Currency (CBDC), as well as their motivations and intentions regarding the issuance of Central Bank Digital Currency. The survey was also conducted in the fall of 2021. Banks Evaluation Request centralization of the use of stablecoins and other cryptocurrencies (or crypto assets) in their jurisdictions.”

He adds: “Over the course of 2021, the work in digital central bank currencies gained more momentum. After the Bahamas launched a CBDC (sand dollar) retail banking currency in 2020, Nigeria followed in 2021 with the issuance of eNaira, and the Eastern Caribbean while the United States launched China is beta versions of its own DCash4 and e-CNY, and there is likely to be more to come: A record share of central banks in the survey (90%) participate in some form of CBDC work.” Testing and Testing

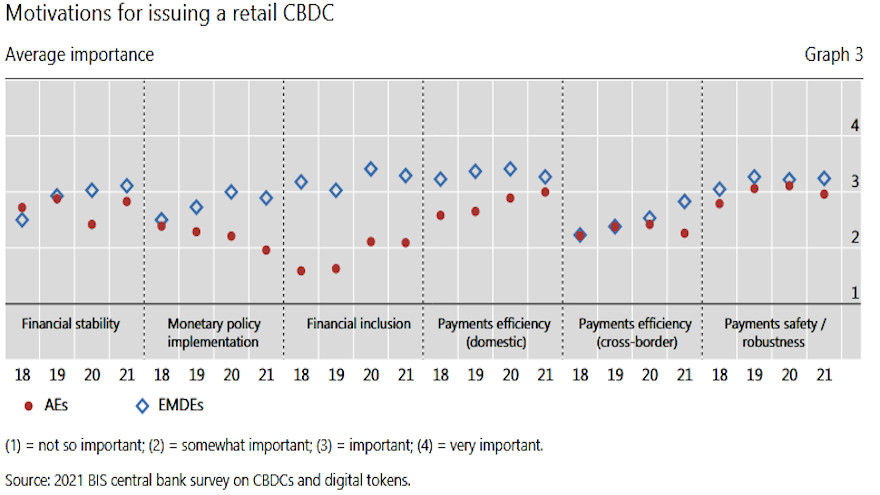

Central banks’ motives for launching their own cryptocurrency

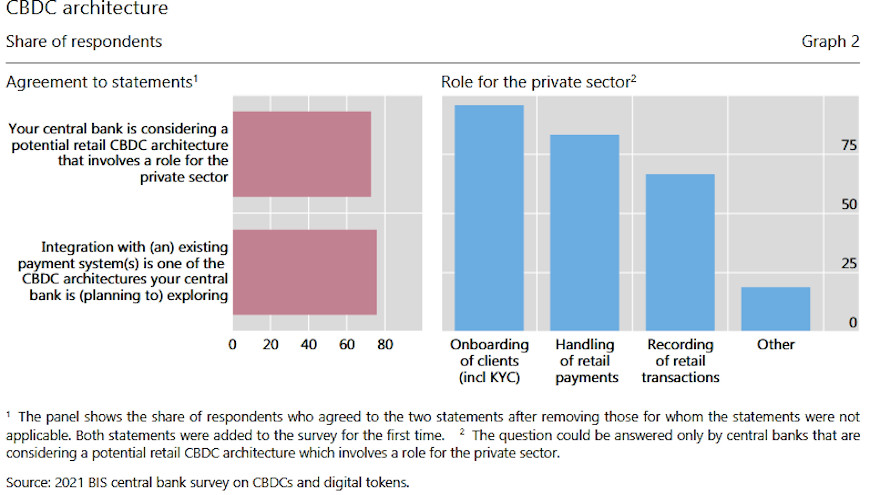

According to the findings, more than half of the central banks surveyed are either developing central bank digital currencies or “conducting concrete experiments.” In addition, about 20% are developing or testing digital currencies for retail digital currencies, which is twice the number of central banks working on wholesale digital currency.

The report adds that central banks are seeking to strengthen their banking infrastructure and digital payments.

Also, according to the CBDC tracker Atlantic Council87 countries representing more than 90% of the global economy are working on central bank digital currencies. “On average, nearly six out of 10 central banks surveyed said this growth has accelerated their work in digital central bank currencies,” the report says.

The jurisdictions represented in the BIS survey represent approximately 76% of the world’s population and 56 of the central banks surveyed represent emerging and developing economies.

While the central banks of the Bahamas, China and Nigeria have already issued or tested central bank digital currencies for retail sale, the survey found that other jurisdictions are 68% likely to follow in the “foreseeable future.”

Other encryption issues

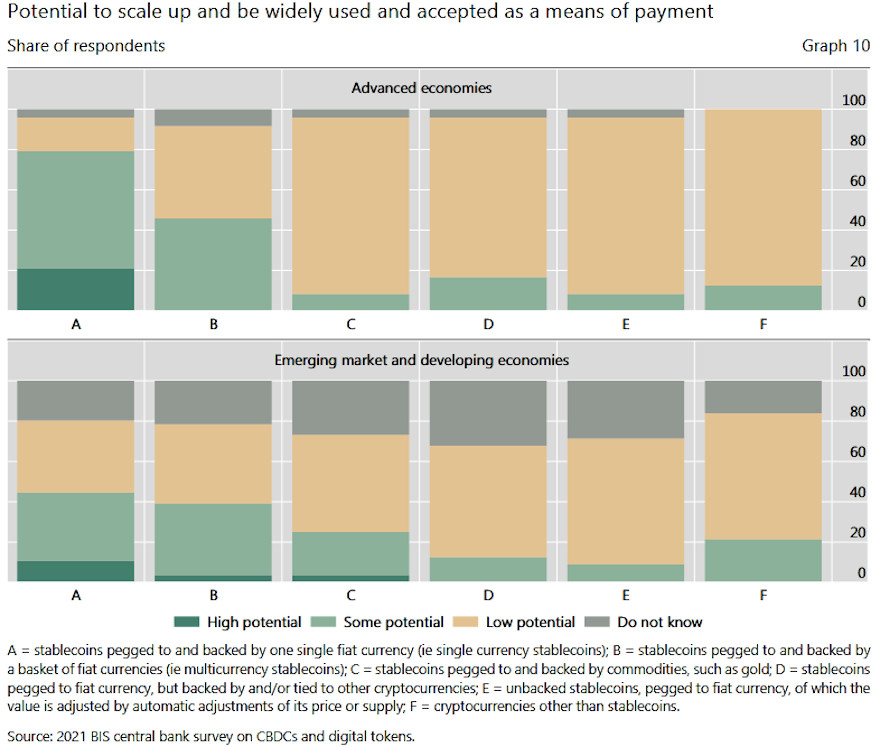

“Central banks differ in their expectations that stablecoins will grow and become more widely used and accepted as a means of payment, depending on the type of stablecoin,” the report said, adding that central banks seem to believe that stablecoins are backed by a single currency. It is more likely to succeed as a payment method on other types of commodity-linked stablecoins or other cryptocurrencies.

About 70% of central banks are studying the potential impact of stablecoins on monetary and financial stability, while about a quarter are looking at the use of cryptocurrencies, Diario Bitcoin reports.

“Unapologetic pop culture trailblazer. Freelance troublemaker. Food guru. Alcohol fanatic. Gamer. Explorer. Thinker.”