It’s an exciting thing when you think about growing your business. But it indeed comes with many hardships and requires lots of planning. Apart from this, a successful business has many branches where you need to pay attention. So, payroll processing and management are one of those branches and responsibilities. It could be confusing, especially if you are new to this. Furthermore, payroll errors can quickly spring up and mess up the whole thing. But to educate yourself on this, let’s start with the basics.

What is payroll processing? A breakdown of the definition:

The payroll involves wages, salaries, taxes, and employment laws. So, the whole process could be a bit laborious due to these things. If you don’t process the payroll in the right way, it can result in fines and penalties. Thus, if you want to avoid late fees, it’s crucial to maintain accurate payroll processing.

“Payroll processing is a way that businesses take to pay employees at the end of a specific time.”

However, the process involves many steps to ensure that we are going on the right track. For instance, you need to focus on the calculations, taxes, deductions, and company benefits. Here are the reasons why you need a sound payroll system.

| Track employee’s working hours | Employee’s wages | Record deductions and tax withholdings |

| Help to keep the documents and records organized | Great to track deposits and payments |

Usually, there is a separate person who maintains the payroll processing, but you can do it with your skills too.

Things to know about payroll processing:

Apart from the above definition, it would help if you knew about the crucial things you shouldn’t overlook. It helps to avoid the unnecessary hardships that can lag your business behind.

- Every state sets a minimum wage rate, and if the state’s min wage is higher than the federal, you will have to pay the higher one.

- You can’t deduct an employee’s uniform expenses from the pay.

- Moreover, you can’t ask employees to work in the off-hours.

So, while calculating payroll, it’s vital to consider the above points. Thus, it doesn’t matter if you have one or more workers; payroll processing and management are necessary. If you ignore this, then your business can bear serious consequences.

Steps for the payroll processing: A guide for the beginners:

Many things are involved in payroll processing, from wage calculation to payroll taxes. We broke down the whole process into the following parts:

Get the EIN:

The term EIN stands for an employee identification number, and it’s vital for payroll processing. It is a unique number that every business has for the IRS. So, the federal and state agencies use the EIN to identify employees and business information. For instance, agencies make sure that you are paying taxes on time or not. We may use the term SS-4 OR TAX ID for the EIN, and both are the same things. So, if you want EIN, apply directly at the official website of the IRS. You can apply online using mail or fax, making the process more convenient.

Collect employee’s data:

At the second stage, you need to accumulate employee data but ensure its accuracy. Apart from this, it is vital to understand the difference between a self-employed employee and a person following Workation. All types of working-class impact income, social security, and unemployment taxes. So, it’s critical to understand the difference between both. Above all, get these documents:

- IRS W-4 form keeps track of allowance that employees are getting but make sure to fill out the latest version of the form.

- State W-4 form helps to calculate the local income tax

- USCIS I-9 form approves that employee has permission to work on the premises of the USA

- You need a Direct deposit enrollment application if you plan to pay through printed paychecks.

Apart from this, don’t forget to get personal information like contact details, emergency contact, benefits enrollment, etc. It’s better to create a simple checklist to ensure you have obtained all details.

Decide about the payroll schedule:

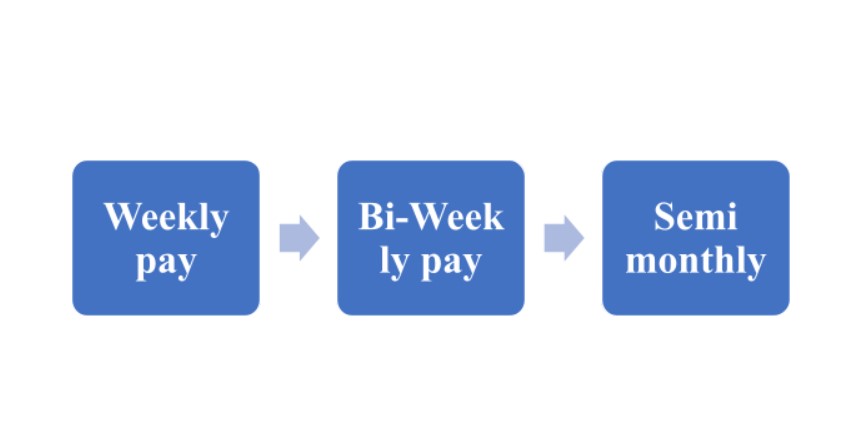

The other vital thing is to decide how often you will pay the employees. There are specific patterns of the paychecks that you can follow. Here are some standard options that you can adopt:

Moreover, if you will pay through check, establish a bank account specifically for the payroll. You can choose any above methods that go best with your needs and situation. But before paying, divide employees into different classifications. For instance, sort out workers that are independent contractors and full-time. If you hold payroll taxes of IC, you can end up having to pay back the taxes along with penalties and interest.

Decide about payroll processing system:

Payroll processing isn’t a difficult task as you only need to head in the right direction. Here are options that you can use to manage payroll:

| Do the payroll taxes manually (You need the knowledge to calculate payroll taxes) |

| Payroll processing yourself (Costs less but time-consuming) |

| Use a payroll processing service (Ideal for small businesses) |

| Hire a professional (Most expensive) |

Indeed, there are specific pros and cons of each type. But hiring a professional is the most expensive. Furthermore, it’s the easiest option if you choose to use a payroll maker. You only need to find the service, fill out the W-4 form, and register for the EIN. A small company using payroll service can spend the saved time on essential business features.

Produce your payroll using pay stub maker:

After gathering all information, now is the time to produce payroll using the service. There is much online software that helps employees to make the process easy. However, here are steps that you need to follow:

- Choose a paystub maker service

- Add the details of working employees

- Track the working hours using different time tracking software

- Process the payroll by clicking on the SEND

Most importantly, it would help if you kept the IRS required record for up to three years. Apart from this, don’t forget to check tax-related rules and requirements in your state. But don’t terminate the record after successful payroll processing because you may need it afterward. It’s better to create a record management system where you can store all vital documents and employee information. For instance, take the help of iCloud storage, an online storage service, paper files, etc.

Calculate deductions and pay employees:

After getting all information, the next step is to calculate deductions. It’s the most crucial step, and small businesses consider it the toughest. You can divide the deductions into the following parts:

- Pre-tax deductions that happen before withholding taxes

- Tax deductions are for the federal payroll taxes

- Post-tax deductions are calculated after withholding taxes

After completing all calculations now, it’s time to pay employees. You can use direct deposit, pay cards, or printed checks for payment. Furthermore, after payroll processing, send the record to government agencies for further work.

“Wannabe internet buff. Future teen idol. Hardcore zombie guru. Gamer. Avid creator. Entrepreneur. Bacon ninja.”