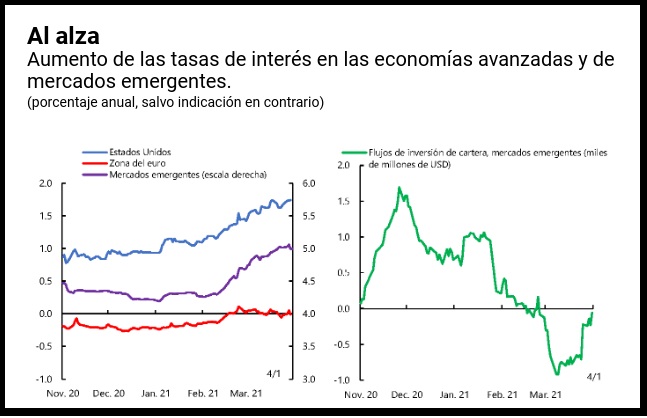

By Philip Engler, Roberto Piazza, and Galen Sher (IMF members) Washington, DC, April 6. The rapid deployment of vaccines in the United States and the approval there of a US $ 1.9 trillion fiscal stimulus package gave impetus to expectations of an economic recovery. In anticipation, long-term interest rates in the US rose rapidly: the rate of 10-year Treasuries fell from less than 1% at the start of the year to more than 1.75% in mid-March. There has been a similar rise in the UK. In January and February, interest rates rose somewhat in the euro zone and Japan, before their central banks intervened to ease monetary policy. Emerging and developing economies are anxiously viewing the rise in interest rates. Most of them are facing a slower economic recovery than advanced economies, have to wait longer to get vaccinations and have limited room for their financial stimulus. Currently, capital flows to emerging markets are showing signs of exhaustion. There is a fear that the shock cycle over the withdrawal of monetary stimulus will repeat in 2013 (the “gradual tantrum”), when signs that there will be a gradual pullback of US bond purchases earlier than anticipated sparked a capital surge from emerging markets. Are these fears justified? According to our study in the latest edition of the WEO, what matters in the case of emerging markets is the reason behind the rise in US interest rates. Cause and effect When that cause is good news about employment in the United States or COVID-19 vaccines, most emerging markets tend to see an increase in investment flows into the portfolio and a reduction in price spreads for US dollar-denominated debt. In advanced economies, it may lead to export growth in emerging markets, as the natural boom in economic activity tends to raise domestic interest rates. In general, the impact on an emerging market in the middle of the market is benign. However, countries that export less to the US but rely more on external debt could face financial market strains. When news of rising inflation in the US causes interest rates in the US to rise, the effects on emerging markets are often benign as well. Interest rates, exchange rates and capital flows in general are not affected, perhaps because previous inflation surprises were the result of a combination of positive economic news, such as increased appetite for spending, and negative news, such as an increase in production costs. However, when high interest rates in advanced economies are driven by expectations that central banks will adopt more restrictive measures, this may affect emerging market economies. Our study reflects these “monetary policy surprises” as interest rate increases on days when periodic announcements occur to the Open Market Operations Committee of the Federal Reserve or the European Central Bank Board of Directors. Note that every one percentage point increase in US interest rates attributable to a “monetary policy surprise” usually immediately causes long-term interest rates to rise by a third of a percentage point in the average emerging market. A third of a percentage point for those with a low credit rating and speculative score. When all things equal, there is an immediate inflow of portfolio capital from emerging markets and their currencies depreciate against the US dollar. One of the main differences from the increase in good interest rates is that the “term premium” – compensation for the risk of holding debt with longer maturities – increases in the US when Tighter monetary policy is being announced unexpectedly, and with it, dollar-denominated emerging market debt margins. In fact, the good news is the combination of these reasons is raising interest rates in the United States. For now, the “good news” on the economic outlook is the main factor. In some emerging markets, expectations about economic activity have rebounded between January and March, which could partly explain the increase in interest rates and the increase in capital flows in January. Overall, the subsequent rise in US interest rates has been moderated, with the markets doing well. Even though long-term interest rates have risen in the US, short-term rates have remained close to zero there. Equity prices remain elevated, and interest rates on dollar-denominated corporate and emerging market bonds have not deviated from US Treasury bond rates. Moreover, market expectations about inflation appear to have been contained at levels close to the Fed’s long-term target of 2% annually. If they stay there, they can help curb the rise in interest rates in the United States. Part of the increase in US interest rates was a result of the normalization of investor expectations about inflation in that country. Proceed with caution however, other factors seem to play a role as well. Much of the increase in US interest rates is due to higher term premiums, which could be a reflection of more uncertainty among investors regarding inflation, the pace of future debt issuance, future debt and bond purchases by central banks. Capital outflows from emerging markets in February and early March turned into inflows in the third week of March, but have remained volatile since then. It is also unclear whether the large volume of Treasury bonds that the US is expected to issue this year will exclude borrowing in some emerging markets. So the situation is fragile. In advanced economies, interest rates remain low and may continue to rise. Investor confidence in emerging market economies could deteriorate. In order not to have such an impact, central banks in advanced economies can help by providing clear and transparent communications about the future course of monetary policy under various scenarios. A good example of this is guidance on basic requirements for increasing intervention rates from the Federal Reserve. Amidst the recovery, it would be useful to have additional guidance on potential future scenarios, given that the Fed’s new monetary policy framework has yet to be tested and market participants have doubts about the speed of growth. Assets in the future. Emerging markets will only be able to provide supportive policies if domestic inflation is expected to be stable. For example, central banks in Turkey, Russia and Brazil raised interest rates in March to control inflation, while central banks in Mexico, the Philippines and Thailand kept them unchanged. Preferably, emerging and developing economies seek to partially offset the rise in interest rates with a more appropriate domestic monetary policy. To do so, they need some independence from global financial conditions. The good news is that many central banks in emerging markets have managed to moderate their monetary policy during the pandemic, even in the face of capital flight. Our analysis suggests that it was economies with more transparent central banks, rule-based financial decision-making procedures, and higher credit ratings that were able to lower rates of intervention the most during the crisis. Given the continuing high level of risk tolerance in global financial markets and the potential for widening gaps between markets in the future, it is time for emerging market economies to extend debt maturities. Specific balance sheet currency mismatch, and more generally, steps to enhance financial flexibility. It is also time to strengthen the global financial safety net, and the system of mechanisms such as mutual lines of credit and multilateral lenders that can provide foreign exchange to countries in need. The international community must be ready to assist countries in extreme scenarios. Prudential financial services provided by the International Monetary Fund can boost the reserves of member states in the face of financial fluctuations; A new SDR allocation would also help.

“Unapologetic pop culture trailblazer. Freelance troublemaker. Food guru. Alcohol fanatic. Gamer. Explorer. Thinker.”