Hong Kong officials announced Thursday 75 basis point rise in benchmark interest rates after the US Federal Reserve Make a similar increase Against inflation.

Therefore, the rate is set at 2%, as indicated in the report of the Hong Kong Monetary Commission, which is the central bank of the former British colony, which is owned by China but has autonomy in areas such as border control or, more specifically, monetary policy. .

Since its inception in 1983, the Hong Kong dollar has followed in the footsteps of the central bank, placing its interest rates above 50 basis points above the limit set by the North American central bank. . Or according to the local benchmark Interbank lending rate, Hibor will always choose the higher of these two options.

Therefore, the central bank has kept its spread between 1.5% and 1.75% and hyper over 0.2%. The Monetary Authority raised its reference rate from 1.25% to 2%.

Local newspaper South China Morning Post Explained If the central bank follows its plan, rates in Hong Kong will rise to about 4% By the end of 2023 their rates will be 3.75%.

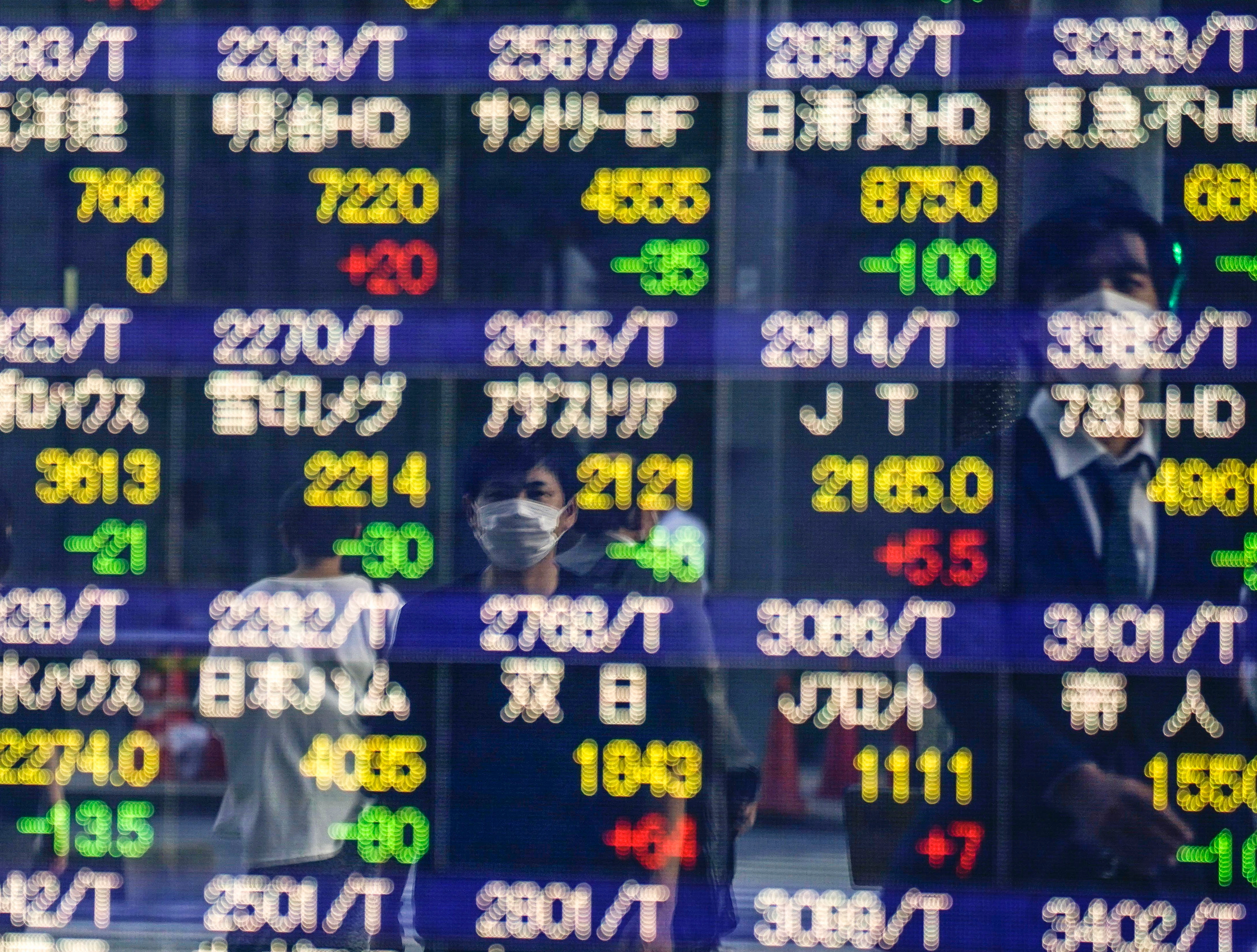

The same newspaper quoted local government finance secretary Paul Chan as saying Rising rates, coupled with inflationary pressures, could lead to more “transitions” in global stock markets.And Hong Kong exports will be affected.

Similarly, Chan predicted that more capital would flow out of Hong Kong due to rising rates in the United States. The city’s banking sector is said to be “on the rise” with more than HK $ 280 billion ($ 35,670 million, 34 34,159 million) Cash flow was “more than enough to maintain the stability of the local financial system”.

The Hong Kong economy has suffered in recent years, with GDP shrinking for six consecutive quarters since mid-2019, first due to pro-democracy protests that year and then the impact of the Govt-19 epidemic.

In 2019, domestic GDP fell by 1.7%, still by 2020 (-6.5%), and by 2021 it will rise to 6.3%; However, in the first quarter of this year, the Hong Kong economy contracted again, especially by 4% year-on-year.

(With information from EFE)

Continue reading:

“Incurable web evangelist. Hipster-friendly gamer. Award-winning entrepreneur. Falls down a lot.”