The Trump administration wanted to remove the assets of the Chinese company that owns the ubiquitous video-sharing site Dictok. Beijing was dismantling technology companies, and India was blacklisting some of its social media applications.

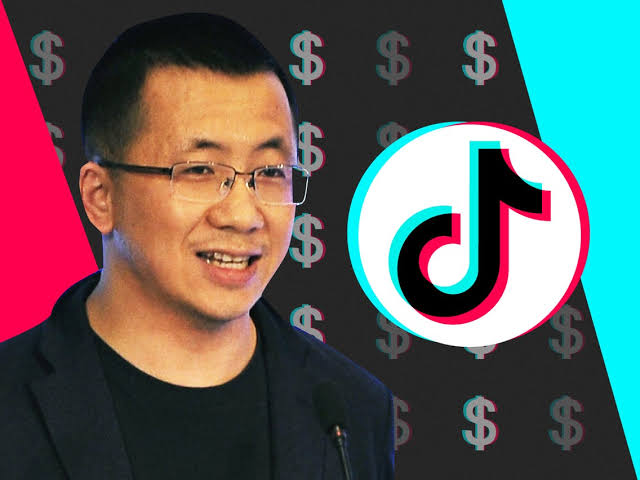

Despite all the obstacles, Bite Dance continued to grow. Now its founder, 38-year-old Zhang Yiming, is one of the richest men in the world, and of late has caused much danger in China.

Versace Palace’s ‘Digital Revolution’ and its first appearances on Dictoc:

The company’s stock is traded on the private market at an estimated value of more than $ 250 billion, according to those familiar with the transactions. At that level, Zhang, who owns a quarter of Bite Dance, could be worth more than $ 60 billion, along with members of the Tonynt Holdings’ Pony Ma, Bottle Water King Jong Shanshan and the Walton and Koch families of the United States. To the Bloomberg Billionaires Index.

Short video applications and news aggregator Tuticorin doubled its revenue last year after expanding beyond its main advertising business in areas such as Fight Dance, e-commerce and online games. Now he is weighing the options for the initial public offering of some companies.

“Zhang is known for his long-term thinking and is not easily deterred by short-term setbacks,” said Mao Zedong, a partner in venture capital firm Synaptic Ventures. “He is committed to building a sustainable global business.”

Increasing rating: During its latest round of fundraising, Bite Dance reached an estimated $ 180 billion, says one expert on the subject. That was more than $ 20 billion three years ago, according to CB Insights. But in the private market, people have said that some investors have recently asked for an equivalent of $ 350 billion worth of delisting. Its value to private equity investors is approaching $ 400 billion, according to a report by the South China Morning Post. This would mean even bigger luck for Zhang.

A year in 60 seconds: Dictok’s best in Mexico by 2020: Bite Dance representatives did not respond to requests for comment.

Being rich in China is a difficult time as the government seeks to control the country’s most powerful companies and their billionaire founders. Ask Jack Flour. Following the launch of the no-confidence motion, regulators fined Alibaba $ 2.8 billion and ordered the central bank to reconsider its Ant Group fintech empire.

Although Bite Dance is not isolated as a target, its dominance in social media and its battle chest for dealing are important areas that the government is investigating.

“There are no more fun games in the United States with Trump and the potential barriers or forcible sale of assets,” said Kirk Putri, founder of investment research firm Redex Holdings. “But technology stock prices and the pressure on China in particular could hardly sell $ 250 billion,” he added, noting the value of Bite Dance in private transactions.

Born in Longian, South China, Zhang, the only son of a civil servant, studied programming at Nangai University in Tianjin, where he adjusted his classmates’ computers and followed them to the school’s online forum. He joined Microsoft shortly after graduation and later called the job so boring that he often “worked half the day and read books the other half,” according to an interview with Chinese media. He created various businesses including a real estate search portal.

While working in a four-room apartment in Beijing in 2012, Byte created Dance’s first success – the humor sharing app was later shut down by Beijing auditors. It turned to news aggregation before winning over a billion global users through its short video sites Dictok and the Chinese sister app Duo. In the process, it has attracted big name investors such as Softbank Group, Sequoia Capital and privately owned trading firm Suskehna International, which has become rare among Chinese Internet start-ups, generally within the broader ecosystems of Tencent and Alibaba Group Holdings.

Novel comment: Susquehanna, one of Jong’s early supporters, became the largest external supporter of Byte Dance with a 15 percent stake, according to an article in the Wall Street Journal in October. In early 2012, when Bite Dance’s news app Tutiao Zhang was a concept designer in Napkins, according to John Wang’s 2016 blog post that led to investment in Susquehanna’s unit of Chinese venture capital.

Faced with dictatorial research in the United States and India, Zhang has put much effort into Bite Dance’s new and fast-growing Chinese businesses, from sports to education to e-commerce. This helped boost sales last year to about $ 35 billion and operating profit to $ 7 billion, said someone familiar with the results.

Investors are expecting the IPO of some of Bite Dance’s businesses at the highest price on the Internet since Uber after Chinese rival Guizhou Technology raised $ 5.4 billion in February. The market value of the company is now approaching $ 140 billion. Last month, Bite Dance appointed former Xiaomi Corp executive Chew Show Ji as its CFO, filling a vacancy that will be critical to its final market offering.

For Zhang, it’s not just about the immediate benefits. The founding founder is known for his business philosophy of “delaying pay” as he focuses on long-term growth, he reiterated during a spill he gave to employees at the company’s ninth anniversary last month.

“Keep a normal mind, it’s easy, but important,” he said. “Express simple words. Eat when you’ve hungry, sleep when you’ve tired.”

“Incurable web evangelist. Hipster-friendly gamer. Award-winning entrepreneur. Falls down a lot.”