Trending Now

Cinema tickets can now be paid with Bitcoin

AMC Theaters is one of the most popular movie companies and theaters in the United States and Canada. Although they were part of...

WORLD

TECH

Rockstar has announced that Jobs will soon be removed from the game

Since the launch of Grand Theft Auto Online in October 2013, Rockstar Games has continued to add content to the online multiplayer portion of...

What are the risks of group video calls in the application?

WhatsApp already has more than two billion users around the world. The platform is owned by Facebook Inc Restless, because it recently...

Sonic Adventure 3 Hints from Sonic Team Leader Takashi Iizuka

All eyes are on vocal boundaries Now and the lackluster response from fans to the early stills shown this week. In a new...

ECONOMY

Litigation: India seizes $725 million from accounts of Chinese Xiaomi

Indian authorities said on Saturday they had seized $725 million from local...

Robinhood Opens Cryptocurrency Wallet to Beta Testers

Robinhood has announced plans to test a cryptocurrency wallet on its app. At the time, the company said it would open the beta...

Name reveal: Baby Thor and Jana Schullerman is here!

The wait is finally over! For a few days, it was clear that it wouldn't be long before the supervisors' baby Jana, 34,...

What Bergoglio said about Ratzinger

Pope Francesco Not a tribute man. Or at least that's what he used to do. But the Jesuit often makes an exception...

Ukraine and Putin’s show of force in the annexed regions: “United Russia won the...

The international community considered this tour illegal. Moreover, verifying the authenticity of votes is impossible. But on the Russian side, the demands...

SPORT NEWS

Hai New Zealand: The verdict is not up to par | free press

Ryan.

New Zealand coach Danny Hay has criticized FIFA for its ruling following the World Cup finals loss in the intercontinental play-off.

"FIFA made...

Benjamin Ponzi surrenders to Stefanos Tsitsipas after a good resistance in the first round...

Hitting an ace on an ace to start his match (nine aces in the first set alone, fourteen in total), Stefanos Tsitsipas wasn't...

Watch Bayern Munich vs RB Salzburg Live on ESPN 2: Watch the match live...

Follow here the match transmission between Bayern Munich against RB Salzburg (LIVE | ONLINE | LIVE), who will...

Nagelsmann surprised by Lewandowski ‘best striker in the world’

Bayern Munich qualified for the knockout stages of the Champions League by throwing Benfica Lisbon on Wednesday at the Allianz Arena (5-2). Robert...

SCIENCE

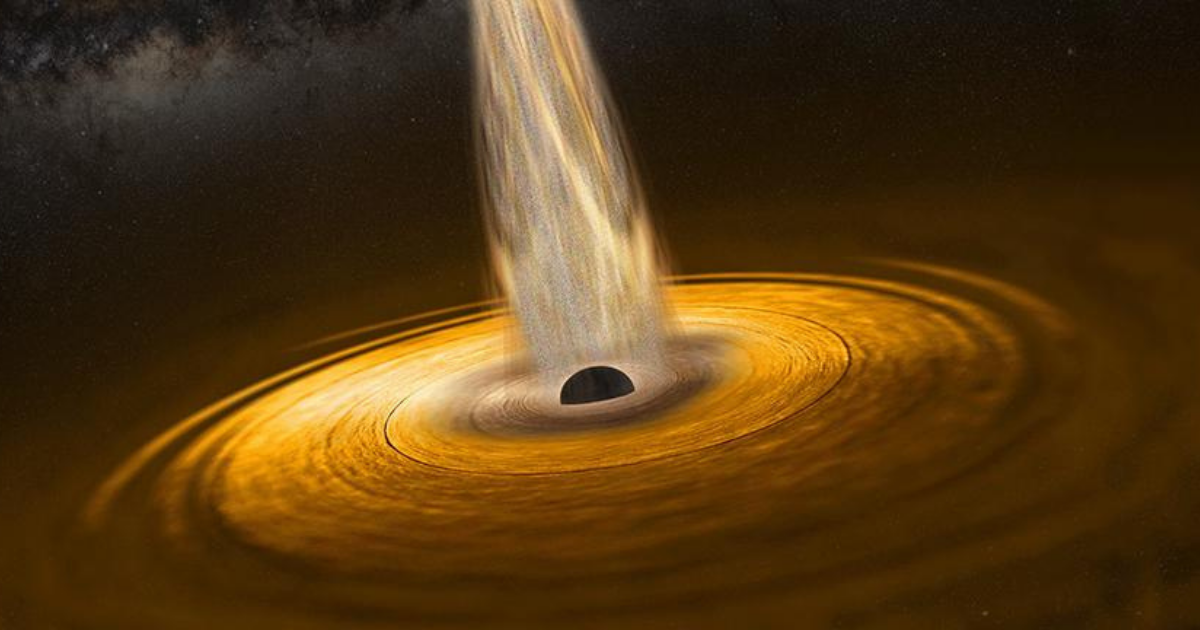

This discovery once again confirms Einstein’s amazing progress during his time

For the first time, astronomers have been able to see the back of a black hole, thus proving that Albert Einstein was indeed right,...

LATEST ARTICLES

Latest article

A city in Japan can no longer handle the tourists who come to photograph...

Fujikawaguchiko is a Japanese city with a population of about 26 thousand people located at the foot of Mount Fuji, the highest mountain in...

Air conditioner, with this trick you can cool your car instantly and save a...

Air conditioning, this is the trick to saving money - sourcedepositphotos.com - autoruote4x4.comSummer is coming: discover the trick to optimize your air conditioner...

Georgia Meloni feels trapped, trapped, as if she were in 41 bis: “I don't...

Giorgia Meloni feels "under siege". Also "surrounded". As if it were “under 41 bis”, the maximum security system that mafiosi and terrorists...